Auto loan amortization calculator with extra payments

This includes auto RV personal or student loans certain types of promissory notes contracts for deed 1st and 2nd mortgages and so on. An interest-only loan allows for lower payments during the loan term and might make sense when borrowers expect higher income in the future.

![]()

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

The first way is to add a little bit to your monthly payment.

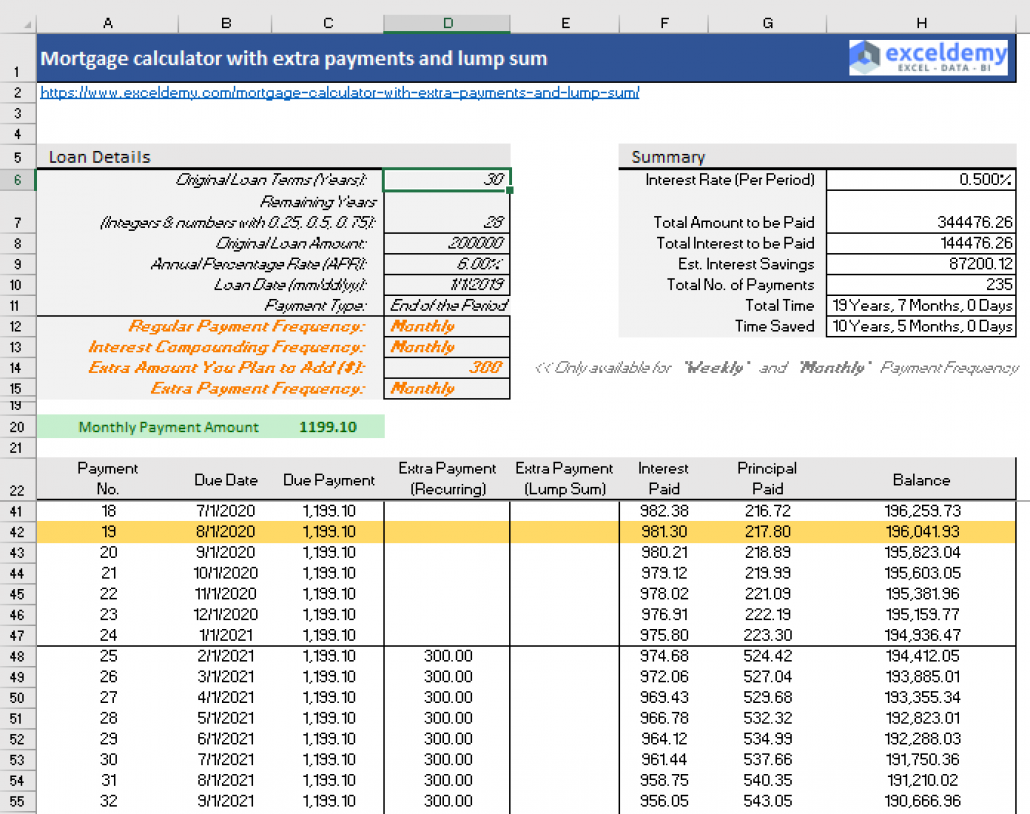

. A person could use the same spreadsheet to calculate weekly biweekly or monthly payments on a shorter duration personal or auto loan. The total saved reflects the savings if you pay the same extra every month at the start of the loan. Use the Extra Payments Calculator to understand how making additional payments may save you money by decreasing the total amount of interest you pay over the life of your home loan.

Here is some important information you should keep in mind whenever using the extra payment calculator. Student loan repayment calculator. The calculator considers all on time late missed and extra payments.

The second way is to make payments more frequently. Home loan repayment. Dependable service is a factor when claims are filed and requests made.

It can also accommodate payment and interest rate changes. And it can be used from either a lenders perspective or from a borrowers perspective. Factors to Consider When Using the Extra Payment Calculator.

The Loan Balance Calculator can be used to track variable payments on any monthly installment loan. Some of Our Software Innovation Awards. An interest-only loan differs from standard loans in that borrowers pay only interest for the duration of the loan.

Enter your loan information and find out if it makes sense to. We use named ranges for the input cells. A 225000 loan amount with a 30-yea r term at an interest rate of 3375 with a down-payment of 20 would result in an estimated principal and interest monthly payment of 99472 over the full term of the loan with an Annual Percentage Rate APR of 3444.

Allows extra payments to be added. Our Simple Excel loan calculator spreadsheet offers the following features. You can pay extra payments to save on the loan interest.

It will show you the breakdown between interest and principal in your loan arrangement the specific monetary amount put towards interest and the amount applied towards the principal balance. If you start making extra payments after the loan inception date the figure may. This simple loan calculator that can be used as an amortization calculator as well lets you estimate your monthly loan payments or any other selected payment frequency.

If financing through a dealership to capture the manufacturers zero or low interest rates use a payment amortization chart to verify your monthly payments. In doing so you will arrive at the payoff you will need to pay every month over the life of the loan. Due Date The day on which payments are required.

The mortgage amortization schedule shows how much in principal and interest is paid over time. An installment loan is a loan that a bank has amortized over regular equal payments. Work with reliable companies that offer the best rates when pinning down the finance and insurance details.

We have offered a downloadable Windows application for calculating mortgages for many years but we have recently had a number of people request an Excel spreadsheet which shows loan amortization tables. This type of calculator works for any loan with fixed monthly payments and a defined end date whether its a student loan auto loan or fixed-rate mortgage. The entire principal balance comes due at the loans maturity date.

Take your simulated loan a step further by selecting show amortization schedule to see a detailed month-by-month schedule leading up to your final payoff date. Conforming Fixed-Rate estimated monthly payment and APR example. You can use the auto loan early payment calculator backward to find out how much youll be spending to pay off the car loan within a specific period.

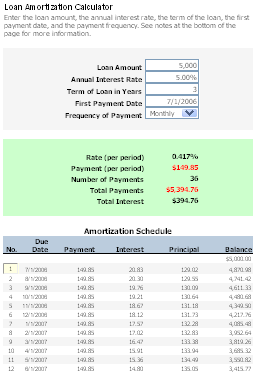

An amortization schedule is a complete table of periodic loan payments showing the amount of principal and the amount of interest that comprise each payment until the loan. The loan amount the interest rate and the term of the loan can have a dramatic effect on the total amount you will eventually pay on a loan. Loan Term The amount of time to pay the loan off.

Even if you can add an extra 10 or 20 each month that money helps shorten the amount of time youll have the loan. Use the PPMT function to calculate the principal. By default this calculator is selected for monthly payments and a 30-year loan term.

Amortization Schedule A table of all payments for the entire loan term showing each payment broken out into interest principal and remaining loan balance. The Ultimate Loan Payoff Calculator will do the job if you are searching for any of these calculators. Estimated monthly payment and APR calculation.

The calculator also includes an optional amortization schedule based on the new monthly payment amount which also has a printer-friendly report that you can. We use the PMT function to calculate the monthly payment on a loan with an annual interest rate of 5 a 2-year duration and a present value amount borrowed of 20000. This example teaches you how to create a loan amortization schedule in Excel.

Since its founding in 2007 our website has been recognized by 10000s of other websites. See how those payments break down over your loan term with our amortization calculator. More precisely its a loan with a fixed interest rate fixed monthly payment and a fixed duration.

Most mortgages auto loans and personal loans are installment loans. Borrower An entity receiving money with a promise to pay it back with. If you have an auto loan of 300 a month and receive biweekly checks consider paying 150 with each check.

This early loan payoff calculator will help you to quickly calculate the time and interest savings the pay off you will reap by adding extra payments to your existing monthly payment. Use our loan payment calculator to determine the payment and see the impact of these variables on a specified loan amount complete with an amortization schedule.

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Loan Amortization With Extra Principal Payments Using Microsoft Excel Amortization Schedule Mortgage Amortization Calculator Money Management Advice

Free Interest Only Loan Calculator For Excel

Extra Payment Mortgage Calculator For Excel

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Easy To Use Amortization Schedule Excel Template Monday Com Blog

Free Loan Amortization Calculator For Car And Mortgage

Auto Loan Calculator For Excel Car Loan Calculator Car Loans Loan Calculator

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Amortization Schedule Create Accurate Payment Schedules

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Biweekly Mortgage Calculator With Extra Payments Free Excel Template